UPDATE - December 16, 2024: On Dec. 4, 2024, a federal district court in Texas struck down the new notice requirement for fixed indemnity coverage in the group market. This new notice requirement was scheduled to be in effect for plan years beginning on or after January 1, 2025, and included group hospital indemnity plans.

As a result, employers sponsoring group fixed indemnity plans, including hospital indemnity plans, are now not required to comply with this new notice requirement. Risk Strategies will continue to follow this development and provide updates when available.

Employers offering fixed indemnity plans, including hospital indemnity policies, to their employees – take note of a new required notice for these plans beginning on or after January 1, 2025.

As we previously reported here, the Department of Health and Human Services (HHS), together with the Department of Labor (DOL) and the Department of the Treasury (collectively, the “federal agencies”), released the Short-Term, Limited-Duration Insurance and Independent, Noncoordinated Excepted Benefits Coverage Final Rules (“final rules”) on March 28, 2024.

The federal agencies released these final rules to increase consumer awareness by helping consumers easily differentiate coverage under fixed indemnity excepted benefit policies and Short-Term, Limited-Duration Insurance (STLDI)[1] from comprehensive health coverage in compliance with the Affordable Care Act (ACA).

Additionally, the final rules require a new consumer notice for fixed indemnity policies (both in the group and individual markets) and STLDI plans. For purposes of this article, the notice requirement for group fixed indemnity plans will be discussed. The new notice requirement applies to plan years beginning on or after January 1, 2025 (both for new and existing coverage).

Read on for more information.

Fixed Indemnity Excepted Benefits Overview

Excepted benefits are exempt from certain federal consumer protections, including certain ACA mandates, such as required coverage for preventive care, prohibition of lifetime and annual dollar limits on essential health benefits, prohibition of preexisting condition exclusions, and waiting period limits.

As with other forms of excepted benefits, fixed indemnity excepted benefits coverage does not provide comprehensive health coverage. Rather, its primary purpose is to provide income or wage replacement benefits that can be used to cover out-of-pocket expenses not covered by ACA-compliant comprehensive health coverage or to offset non-medical expenses (e.g., mortgage or rent) following a health-related event, such as a period of hospitalization or illness. Benefits under this type of coverage are paid in a flat or “fixed” cash amount. Moreover, benefits are provided at a pre-determined level regardless of the actual amount of health care costs incurred by the individual.

Hospital indemnity or other fixed indemnity insurance are “excepted” under federal regulations if all of the following conditions are met:

- the benefits are provided under a separate policy, certificate, or contract of insurance;

- there is no coordination between the fixed indemnity benefits and any exclusion under any group health plan maintained by the same employer plan sponsor; and

- the benefits are paid for an event without regard to whether benefits are provided for such event under any group health plan maintained by the same employer plan sponsor.

Additionally, under existing regulations, hospital indemnity and other fixed indemnity insurance in the group market must pay a fixed dollar amount per day (or other period) of hospitalization or illness, regardless of the amount of expenses incurred, to be considered an excepted benefit.

Specified Disease Coverage:

For clarity, coverage for a specified disease or illness only (such as cancer-only and critical illness policies) are “excepted” benefits when they satisfy the conditions outlined above. However, specified disease coverage policies are not considered fixed indemnity insurance. As such, specified disease coverage policies are not impacted by these final rules.

Fixed Indemnity Excepted Benefits Consumer Notice

These final rules require a consumer notice to be provided to employees when offering fixed indemnity excepted benefits coverage in the employer-sponsored group market.

The rules underscore the view of the federal agencies (as stated in the preamble to the final rules) that these notices “will help ensure that all consumers, including those in underserved communities, have the necessary information to make an informed choice after considering and comparing the full range of health coverage options available to them.”

Fixed indemnity excepted benefit insurers are required to prominently display a notice in at least 14-point font on the first page of any applicable marketing, application, or enrollment materials (or reenrollment) materials that are provided to participants at or before the time participants are given the opportunity to enroll (or reenroll) in the coverage.

The federal agencies confirmed that a notice is considered to be prominently displayed if it is easily noticeable to a typical consumer within the context of the page (either paper or electronic) on which it is displayed.

Prominent Display Examples:

- Using a font color that contrasts with the background of the document

- Ensuring the notice is not obscured by any other written or graphic content on the page, and

- When displayed on a website, ensuring the notice is visible without requiring the viewer to click on a link to view the notice.

This consumer notice requirement for fixed indemnity excepted benefits coverage in the group market, for both new and existing coverage, is applicable to plan years beginning on or after Jan. 1, 2025.

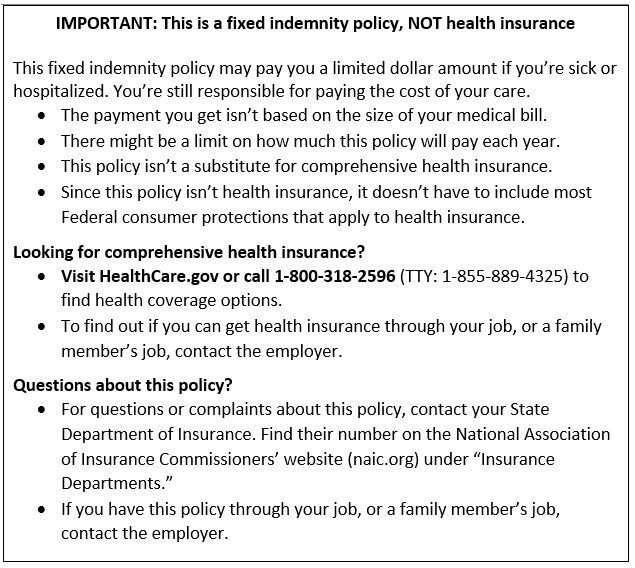

Model Language for Fixed Indemnity Excepted Benefits Consumer Notice

See below for the model language provided in the final rules for group fixed indemnity excepted benefit coverage to comply with this new notice requirement.

Reminder: This group fixed indemnity coverage model notice language must be prominently displayed by the plan insurer in at least 14-point font on the first page of any applicable marketing, application, or enrollment materials (or reenrollment) materials that are provided to participants at or before the time participants are given the opportunity to enroll (or reenroll) in the coverage.

Next Steps for Employers

Plan insurers of group (and individual) fixed indemnity coverage are generally responsible to comply with this new notice requirement by including the model notice language (detailed above) on the first page of any applicable marketing, application, or enrollment materials (or reenrollment) materials for plan years beginning on or after Jan. 1, 2025.

Employers sponsoring group fixed indemnity plans, including hospital indemnity plans, should confirm with their plan insurer that they will comply with this new notice requirement on behalf of their plans beginning on or after January 1, 2025.

For good measure, employers sponsoring group fixed indemnity plans should consider including the model notice language in their own benefits enrollment guides to ensure employees clearly understand the difference between fixed indemnity plan coverage and comprehensive, ACA-compliant group health plan coverage.

Risk Strategies is here to help. Reach out to your Risk Strategies account team for assistance or contact us directly at benefits@risk-strategies.com.

[1] The final rules also revise the definition of STLDI and limit the length of STLDI policy contracts and renewals to a maximum of 4 months.